“Plan Your Tax Savings Before the Financial Year Ends.

Financial year end is round the corner and its a good time to check if your plan is apt !

Now in India, for the general and quick tax savings purpose, there is Section 80 for tax savings, which further has many sub sections within .

1- 80 C is one of the most convenient sections to save tax and will help you save tax on Rs.1.5 L of your total earnings.

Under this there are some lovely options, which not only help you save your taxes but will also help you grow your funds.

And hence today let me take your focus from JUST SAVING TAXES to GROWING your FUNDS and INVESTING RIGHT along with it.

Now from amongst the various popular options available under 80 C which are

– ELSS ***** ( Equity linked savings scheme is a wonderful option to give you an exposure of equity to help you save and grow your funds at the same time. Its convenient vis the mutual fund route )

– ULIPs**** ( Unit linked insurance plan, which gives you double benefit of insurance as well as option to gain with equity and the market growth )

– Bank 5 year FDs **

– Senior Citizen Saving Schemes ***

– EPF and PPF **** ( employee provided fund and public provided fund are safer debt based options with lesser fluctuations )

– NSCs ***

– Pension Plans **

– LICs *

– Children Eduction Fees ( Tuition and Term Fees )

– Principal Repayment of Home Loan

– Sukanya Samriddhi. **** ( for people having a girl kid, either of the parents can have this, but not both )

Where these are the easier options to check how much have you already invested in these funds or you can invest before the financial year ends, there are some other avenues for tax saving too like,

2- NPS ( Under section 80CCD(1B) ) upto 50 K & Employer route NPS ( Under section 80 CCD (1B) ) upto more 10% of your basic salary might be a **** avenue to check out. By the way this is a lovely saving for your post retirement with the added benefit of tax saving.

By the way these are a couple of best investment options to save your taxes and grow your money at the same time. There are several other avenues where you can claim tax exemptions too. For details I’ll leave you a link to a couple of websites below which will give you elaborate details on the tax saving claims that you can make.

Latest Tax Slabs & Best Tax saving investments :

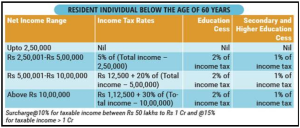

Income Tax Slab Income Tax Rate

Income upto Rs. 2,50,000 —————————Nil

Income between Rs. 2,50,001 – Rs. 500,000 ——10% of Income exceeding Rs. 2,50,000

Income between Rs. 500,001 – Rs. 10,00,000—–20% of Income exceeding Rs. 5,00,000

Income above Rs. 10,00,000 ————————30% of Income exceeding Rs. 10,00,000

Which can be looked at for now.

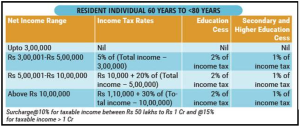

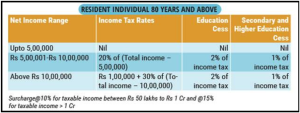

Next year on the new tax slabs would be applicable which looks to be a very proposition for the larger section of middle class and also pretty decent for the next slabs.

The modified slabs ahead would be :